Tether Write for Us

Tether Write for Us – Tether (USDT) is a popular stablecoin that cryptocurrency enthusiasts use after years of growing up in cryptocurrency exchanges. The USDT is indexed on the American dollar. In theory, it has not been affected by the volatility of the march, which can dramatically affect the valuation of other cryptocurrencies, such as Bitcoin.

Last month, Boston Fed President Eric Rosengren sounded the alarm over Tether, calling it a potential risk to financial stability. Meanwhile, some investors believe that the loss of confidence in Tether could be the “black swan” of cryptocurrencies, an unpredictable event that would seriously affect the market. The issues surrounding Tether have significant implications for the developing world of cryptocurrency. And economists are increasingly worried that it could affect markets beyond digital currencies.

Last month, Boston Fed President Eric Rosengren sounded the alarm over Tether, calling it a potential risk to financial stability. Meanwhile, some investors believe that the loss of confidence in Tether could be the “black swan” of cryptocurrencies, an unpredictable event that would seriously affect the market. The issues surrounding Tether have significant implications for the developing world of cryptocurrency. And economists are increasingly worried that it could affect markets beyond digital currencies.

How to Submit Article

To Submitting Your Articles, you can email contact@justtechweb.com

How Does Tether Work?

When a user deposits fiat currency into Tether’s reserve, selling fiat currency to buy USDT, Tether then issues the corresponding digital amount in tokens. USDT can be sent, stored or exchanged.

If a user deposits $100 into the Tether pool, based on a $1 for $1 parity, they will receive 100 Tether tokens. Tether coins are destroyed and taken out of circulation when users exchange them for fiat currency.

Firstly, It moves through blockchains like many other digital currencies. Tether tokens are available on various blockchains, such as the original with Omni on the Bitcoin and Liquid platforms and Ethereum (ETH) and TRON (TRX), among others.

Why is Tether controversial?

Some investors and economists worry that issuer Tether has insufficient dollar reserves to justify its peg to the dollar.

In May, Tether broke the reserves of its stablecoin. The company exposed that only a fraction of its holdings – 2.9%, to be exact – was in cash, while the vast popularity was in commercial paper, a form of short-term unsecured debt.

Tether vs Bitcoin

The main difference between Tether and Bitcoin is that “Tether is a stablecoin…pegged to a real commodity, the USD, while Bitcoin is not pegged to any real commodity,” says Daniel Rodriguez, COO at Hill Wealth Strategies. A wealth management firm in Richmond, Virginia.

Tether is centralized crypto, while Bitcoin is decentralized by not being tied to real-world currency. For this reason, in theory, Tether’s value should remain more stable than Bitcoin’s.

Cryptocurrencies not tied to a real-world asset or currency are subject to market volatility. Most traditional cryptocurrencies like Ethereum, Bitcoin, and Litecoin (LTC) will experience extreme swings and volatility with the market, inflation, and interest rates.

How to Submit Article

To Submitting Your Articles, you can email contact@justtechweb.com

Why Write For Just Tech Web – Tether Write For Us

Search Related Terms To Tether Write For Us

Search Related Terms To Tether Write For Us

Cryptocurrency

Cryptocurrencies

Cryptocurrency Keywords List

Cryptocurrency Terminology Pdf

Crypto Acronyms

5 Letter Words Related To Cryptocurrency

25 Crypto Terms You Should Know

4 Letter Words Related To Cryptocurrency

Cryptocurrency Terms For Beginners

Crypto Phrases

Cryptocurrency Stablecoin

Bitfinex Cryptocurrency Exchange

Bitcoin Blockchain

Stablecoin

Cryptocurrency Wallet

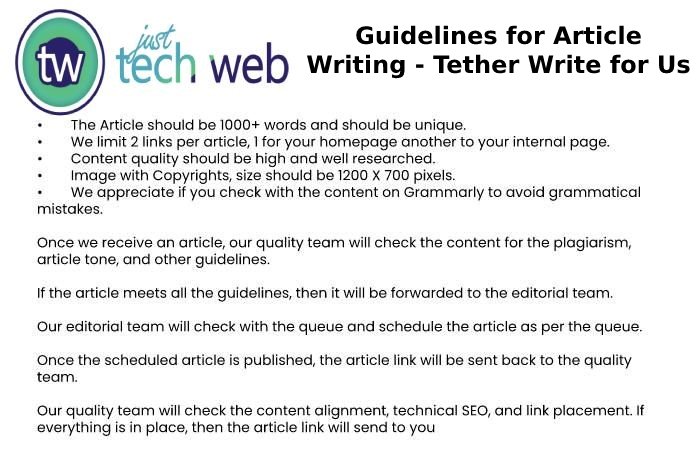

Guidelines for Article Writing Tether Write for Us

Search Terms for Tether Write For Us

Write For Us

Looking For Guest Posts

Guest Posting Guidelines

Become A Guest Blogger

Writers Wanted

Guest Posts Wanted

Submit The Post

Contributing Writer

Guest Post

Becomes An Author

Suggest A Post

Contributor Guidelines

Guest Posts Wanted

Related Pages

Blockchain Technology Write for Us

Content Marketing Write for Us

You can send your article to the contact@justtechweb.com