Income Tax Write for Us

Income tax is often perceived as a burden by taxpayers. But paying income tax doesn’t just benefit you personally. It also helps our nation grow. Read this article to learn about the main benefits of paying income tax.

Income tax is often perceived as a burden by taxpayers. But paying income tax doesn’t just benefit you personally. It also helps our nation grow. Read this article to learn about the main benefits of paying income tax.

How to Submit Article

To Submitting Your Articles, you can email us at contant@justtechweb.com

Paying a particular portion of your hard-earned money to the government regularly may seem inappropriate. The income tax you pay to the government not only benefits you but also promotes the overall development of our country. Before we talk about the benefits of paying income tax, let’s first take a quick look at what income tax is.

What is Income Tax?

Income tax is one of the primary sources of government revenue. Income tax is a type of direct tax that you must pay on your income. Depending on age and the total tax base for a year, each taxpayer is assigned a tax bracket. The taxpayer’s income tax rate depends on the tax bracket to which he belongs.

Like personal income tax, there are other types of direct taxes, such as corporation tax, capital gains tax, etc. Similarly, there are indirect taxes such as Goods and Services Tax (GST) and other types of taxes such as property tax, attractions tax, business tax, registration fees, stamp duty, etc

What are the Benefits of Paying IT?

A tax benefit is any tax law that helps you reduce your tax liability. Benefits range from tax deductions and credits to exclusions and exemptions. They cover various areas, including programs for families, education, employees and natural disasters.

A tax benefit is any tax law that helps you reduce your tax liability. Benefits range from tax deductions and credits to exclusions and exemptions. They cover various areas, including programs for families, education, employees and natural disasters.

Some tax benefits are tied to the ability to pay taxes. For example, the child tax credit and the earned income tax credit consider the cost of raising a family. Other tax benefits, including mortgage interest and charitable donation deductions, are incentives designed to promote social policy goals.

Key Takeaways

- Tax benefits create savings for individuals and businesses.

- Expected tax benefits include deductions, credits, exclusions, and shelters.

- You can take standard or itemized deductions and any available above-the-line deductions.

- To qualify for tax benefits, you must meet specific requirements, such as income limits, filing status, and dependent status.

- Be sure to keep up with any tax benefits you may be entitled to so you don’t miss out on tax savings.

How to Submit Article

To Submitting Your Articles, you can email us at contant@justtechweb.com

Why Write for Just Tech Web – Income Tax Write for Us

Search Related Terms to Income Tax Write for Us

Search Related Terms to Income Tax Write for Us

Corporate Tax

Home Tax

Personal Tax

Telecommunications

Communication Network

Mobile Phones

Digital Pay

Payment Service Provider

Technology News

Network Nodes

New Technology

Networking Hardware

Telecommunication Network

Internet Protocol

What is Technology

Network Topologies

Technology Definition

Digital Interconnections

Science and Technology

Latest Technology

Technology Review

Modern Technology

Science Technology

Technology Meaning

Search Terms for Income Tax Write for Us

Write For Us

Looking For Guest Posts

Guest Posting Guidelines

Become A Guest Blogger

Writers Wanted

Guest Posts Wanted

Submit The Post

Contributing Writer

Guest Post

Becomes An Author

Suggest A Post

Contributor Guidelines

Guest Posts Wanted

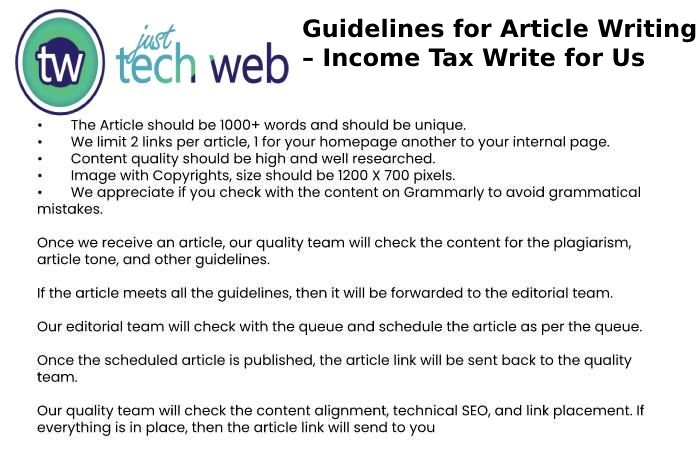

Guidelines for Article Writing – Income Tax Write for Us

Related Pages

Related Pages

Business Software Write for Us

Mobile App Development Write for Us

Inbound Marketing Write For Us

Digital Marketing Write for Us

Artificial Intelligence Write for Us

Communications Technology Write For Us

Computer Hardware Write for Us

Internet Marketing Write for Us

Search Engine Marketing Write for Us

Key Account Management Write for Us

Native Advertising Write for Us

Print Advertising Write for Us

Outdoor Marketing Write for Us

Visual technology Write for Us

Audiovisual Technology Write For Us

Social Networking Write for Us

Educational technology Write for Us

Samsung J2 Battery Write for Us

You can send your article to contact@justtechweb.com