Forex Trading Write for Us

Forex Trading, or foreign exchange, can be explained as a network of buyers and sellers who transfer currencies between themselves at an agreed price. It is how individuals, businesses and central banks convert one currency into another; If you’ve ever travelled abroad, chances are you’ve made a foreign exchange transaction.

While a large part of forex trading is done for convenience, most currency conversion is done for profit. The number of currencies converted daily can make certain currencies’ price movements extremely volatile. This volatility can make Forex appealing to traders – it gives a greater chance of making big profits while increasing risk.

While a large part of forex trading is done for convenience, most currency conversion is done for profit. The number of currencies converted daily can make certain currencies’ price movements extremely volatile. This volatility can make Forex appealing to traders – it gives a greater chance of making big profits while increasing risk.

How to Submit Article

To Submitting Your Articles, you can email us at contact@justtechweb.com

How do Currency Markets Work?

Unlike stocks or commodities, forex trading remains not done on the stock exchange but directly between two parties in an over-the-counter (OTC) market. The forex market does manage by a global network of banks spread over four major forex trading centres in different time zones: London, New York, Sydney and Tokyo. Because there is no central location, you can trade Forex around the clock.

What Moves the Forex Market?

The forex market comprises currencies from all over the world, making currency exchange rate predictions difficult as many factors can contribute to price movements. However, like most financial markets, Forex remains primarily influenced by the forces of supply and demand, and it does essential to understand the influences that drive price fluctuations here.

The forex market comprises currencies from all over the world, making currency exchange rate predictions difficult as many factors can contribute to price movements. However, like most financial markets, Forex remains primarily influenced by the forces of supply and demand, and it does essential to understand the influences that drive price fluctuations here.

How does Forex Trading Work?

There are different ways to trade Forex, but they all work the same: buying one currency while simultaneously selling another. Traditionally, many forex transactions were done through a forex broker. Still, with the rise of online trading, you can take advantage of forex price movements using derivatives such as CFD trading.

CFDs are leveraged products that allow you to open a position for just a fraction of the total value of the trade. Unlike non-leveraged products, you don’t own the asset but decide whether you think the market value will go up or down.

What is the Spread in FT?

The spread is the difference between the quoted bid and asks prices for a currency pair. Like many financial markets, you will be presented with two fees when you open a forex position; if you want to open a long place, trade at the bid price slightly above the market price. If you’re going to open a short position, work at the asking price, slightly below the market price.

How to Submit Article

To Submitting Your Articles, you can email us at contact@justtechweb.com

Why Write for Just Tech Web – Forex Trading Write for Us

Search Related Terms to Forex Trading Write for Us

Search Related Terms to Forex Trading Write for Us

Currencies

Foreign Exchange Rates

Trading Volume

Credit Market

Larger International Banks

Financial Centres

Buyers

Financial Institutions

Interbank Market

International Trade

Carry Trade

Floating Exchange Rates

Exchange Rate Regime

Exchange Rates

Currency Intervention

Search Terms for Forex Trading Write For Us

Write For Us

Looking For Guest Posts

Guest Posting Guidelines

Become A Guest Blogger

Writers Wanted

Guest Posts Wanted

Submit The Post

Contributing Writer

Guest Post

Becomes An Author

Suggest A Post

Contributor Guidelines

Guest Posts Wanted

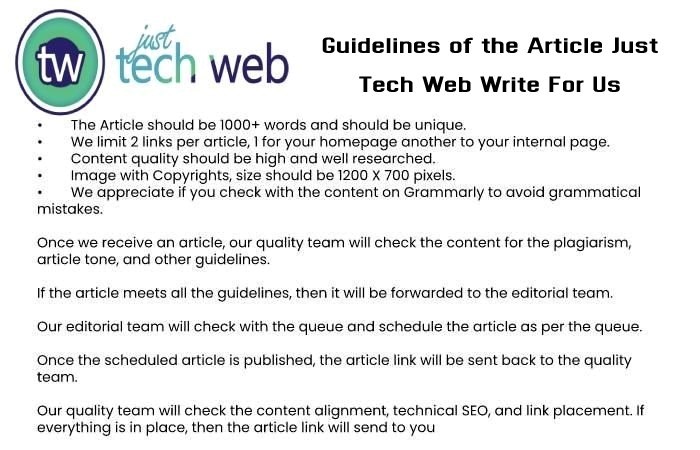

Guidelines for Article Writing Forex Trading Write for Us

Related Search

Audiovisual Technology Write For Us

Business Software Write for Us

Mobile App Development Write for Us

Inbound Marketing Write For Us

Digital Marketing Write for Us

Communications Technology Write For Us

Computer Hardware Write for Us

Internet Marketing Write for Us

Search Engine Marketing Write for Us

Key Account Management Write for Us

Native Advertising Write for Us

Print Advertising Write for Us

Outdoor Marketing Write for Us

Visual technology Write for Us

Social Networking Write for Us

Educational technology Write for Us

Samsung J2 Battery Write for Us

Account-based marketing Write for Us

Artificial Intelligence Write for Us

You can send your article to the contact@justtechweb.com